- Step 7: The Excel will calculate the mean, variance, observations, Pearson correlation, hypothesized mean difference, t statistics, p-value, and more. P-value is easy to calculate and adapt in many different situations. It helps you to get the information you need without spending a lot of time or effort on it.

- A positive correlation indicates that as one variable increases, the other tends to increase. A negative correlation signifies that as one variable increases, the other tends to decrease. The values indicate the strength of the correlation and they can range from -1 to +1. The closer the value is to -1 or 1, the stronger the relationship.

- See full list on howtoexcel.org.

- Jul 20, 2021 The first way to find a p-value from a t statistic is to use an online calculator. In the process of calculating the p-value for a Pearson correlation test in Excel is to. Oct 1, 2018 —.csv (comma separated values) normally saved in Excel. Systems, the UK market share of Windows was 86% and Mac IOS 14%.3.

- Calculate P Value For Pearson Correlation In Excel Using

- How Do You Calculate Pearson Correlation Coefficient In Excel

- How To Calculate P-value From Pearson Correlation

- Calculate P Value For Pearson Correlation In Excel Spreadsheet

- Cached

Pearson Correlation – Calculating r Critical and p Value of r in Excel. Spearman Correlation in 6 Steps in Excel 2010 and Excel 2013 Pearson Correlation Coefficient r in 3 Steps in Excel. Pearson’s Correlation Coefficient, r, is widely used as a measure of linear dependency between two variables.

30 Oct 2014Yesterday, I wanted to calculate the significance of Pearson correlation coefficients between two series of data. I knew that I could use a Student’s t-test for this purpose, but I did not know how to do this in Excel 2013. And, to be honest, I did not really understand the documentation of Excel’s T.TEST formula. So, here is what I did.

Pearson correlation coefficient

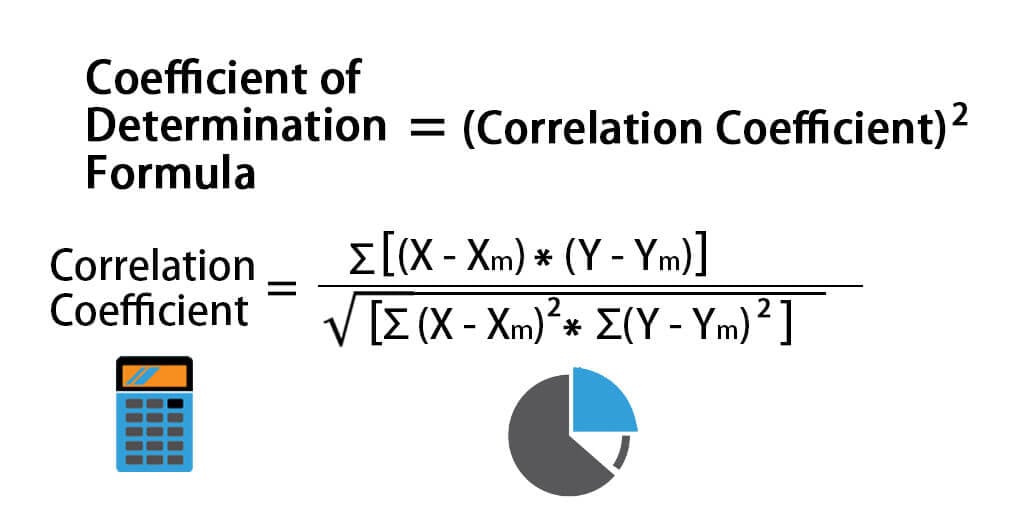

First, I had to calculate the corresponding Pearson correlation coefficients according to this formula:

where rxy is the Pearson correlation coefficient, n the number of observations in one data series, x the arithmetic mean of all xi, y the arithmetic mean of all yi, sx the standard deviation for all xi, and sy the standard deviation for all yi.

Let’s assume, the data series to be correlated are stored in arrays A1:A100 and B1:B100, thus n = 100:

Calculate P Value For Pearson Correlation In Excel Using

=PEARSON(A1:A100;B1:B100)

Alternatively, you could also use the Correl function, which returns the same result:

=CORREL(A1:A100;B1:B100)

(I am using a Swiss German localization, therefore Excel’s delimiter for formula arguments is a semicolon ; rather than a comma , in my case.)

Naturally, the returned correlation value is in the range of -1.0 to +1.0. This value is often referred to as Pearson r or rxy in our case.

t-value

Next, I calculated the corresponding t-values according to this formula:

where t is the t-value, which can be positive for positive correlations or negative for negative correlations, rxy is the already calculated Pearson correlation coefficient, and n is the number of observations again (here n = 100).

Significance testing

Finally, I needed to decide whether the computed t-values were actually significant or not. For this purpose, we need to compare them to pre-calculated t-values available in a t-value table. To do so, it is necessary to decide upon two things:

- What is the desired significance or confidence level, e.g. 95% or 99%?

- Do I want to use a one-tailed or a two-tailed t-test?

In my case, I decided to use a 95% significance level (which is a very common choice for data that are not highly critical). What confused me for some time is that some sources like the already linked Wikipedia-article express confidence positively by stating the degree of certainty (e.g. 0.95 or 95%), whereas others like this one express confidence negatively by the probability for being wrong (e.g. 0.05 or 5%). Other sources again like this one actually state both in a single table. It is essential that you know what the source you are using is referring to! You can always carefully compare the t-values contained in different t-tables with each other to get an understanding whether someone actually takes one or the other perspective. Just check the t-table’s header line containing the probability values. Usually, the t-values are in ascending order from left to right, and in descending order from top to bottom. Hence:

If you want to test the significance of a negative correlation, then you must check whether your t-value t is below a certain critical negative t-value tcrit at the left side of the t-distribution: Is t < tcrit?

Usually, a t-table only includes positive t-values, but not negative ones. How can we then test for the significance of negative correlations? It’s really easy. t-distributions are symmetric with a median of 0, thus their left and right tails look exactly the same. For this reason, we can change our test from “Is t < tcrit?” to “Is ABS(t) > tcrit?”. Instead of checking whether our t-value is below a critical negative threshold, we actually check whether its absolute value is greater than a critical positive threshold.

In case you do not have a very clear idea whether the expected correlation is actually positive or negative because it could be both it is better to use a two-tailed t-test. You can use a one-tailed t-test if you are only interested in one directionality of the correlation but not in the other (e.g. only positive but not negative, or only negative but not positive). Always remember:

p(t) two-tailed = 2 * p(t) one-tailed

The t-table contains in the first column the degrees of freedom. This is usually the number of observations n (i.e. 100) minus some value depending on the context. When computing significances for Pearson correlation coefficients, this value is 2: degrees of freedom = n - 2.

We now have all information needed to perform the significance test. i) We have decided upon a confidence level of 95%, ii) we have decided to use a two-tailed t-test, iii) we have calculated the degrees of freedom to be 98 = 100 - 2. Looking up the critical threshold tcrit in the t-table we find that it is 1.984. Therefore:

- If rxy > 0 AND t > 1.984 then the Pearson correlation coefficient is significantly positive. This would be reported more compactly as: rxy(98) = <value>, p < 0.05 (two-tailed), where <value> is of course the calculated Pearson correlation coefficient.

- If rxy < 0 AND ABS(t) > 1.984 then the Pearson correlation coefficient is significantly negative.

- In all other cases the result is not significant.

Using Excel for t-tests

TINV, T.INV.2T, TDIST, and T.DIST.2T

Of course, calculating critical t-values can be done in Excel too. M3 lite game manager download. Before Excel 2010, there were only the TINV and TDIST formulas, now there are additionally the T.INV.2T and the T.DIST.2T formulas. All these formulas express confidence negatively, that is the probability value p represents the probability for being wrong.

How Do You Calculate Pearson Correlation Coefficient In Excel

=TINV(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =TINV(p;df) is equivalent to =T.INV.2T(p;df). |

=T.INV.2T(p;df) | returns a t-value t for the given probability p and degrees of freedom df, assuming a two-tailed test. =T.INV.2T(p;df) is equivalent to =TINV(p;df). |

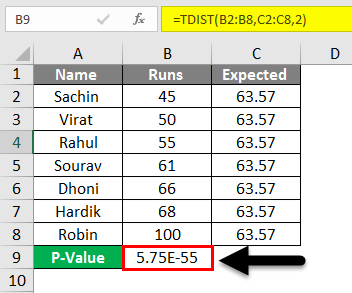

=TDIST(t;df;num-tails) | returns a probability value p for the given t-value t, the degrees of freedom df, and the number of tails num-tails (either 1 or 2). =TDIST(t;df;2) is equivalent to =T.DIST.2T(t;df). Furthermore, =2*TDIST(t;df;1) is equivalent to =T.DIST.2T(t;df). |

=T.DIST.2T(t;df) | returns a probability value p for the given t-value t, the degrees of freedom df, and a two-tailed t-test. =T.DIST.2T(t;df) is equivalent to =TDIST(t;df;2). |

TINV is the inverse of the TDIST formula and vice versa.

Examples: Let p = 0.05 (5% probability of being wrong), n = 100 (therefore df = 100 - 2 = 98). We assume a two-tailed t-test.

- Calculating t for a given p:

=TINV(0.05; 100-2)==T.INV.2T(0.05; 100-2)= 1.9844675. - Calculating p for a given t:

=TDIST(1.9844675;100-2;2)==T.DIST.2T(1.9844675;100-2)==2*TDIST(1.9844675;100-2;1)= 0.05.

T.INV and T.DIST

Since Excel 2010, there is also a T.INV and a T.DIST formula. Confusingly, they actually work quite differently from TINV and TDIST! First, unlike TINV and TDIST, T.INV and T.DIST by default are one-tailed. Second, unlike TINV and TDIST, T.INV and T.DIST actually express confidence positively, that is the probability value p represents the degree of certainty.

=T.INV(p;df) | returns a t-value t for a given probability p and degrees of freedom df, assuming a one-tailed test. =T.INV(p;df) is equivalent to =TINV(2*(1-p);df). |

=T.DIST(p;df;true) | returns a probability value p for the given t-value t, the degrees of freedom df, assuming a one-tailed t-test. =2*(1-T.DIST(p;df;true)) is equivalent to =TDIST(p;df;2). Furthermore, =1-T.DIST(p;df;true) is equivalent to =TDIST(p;df;1). |

Examples: Let p = 0.05 (5% probability of being wrong), n = 100 (therefore df = 100 - 2 = 98). We assume a two-tailed t-test.

- Calculating t for a given p:

=T.INV(1-0.05/2;98)==TINV(0.05;98)= 1.9844675. - Calculating p for a given t:

=2*(1-T.DIST(1.9844675;98;true))==TDIST(1.9844675;98)= 0.05;

How To Calculate P-value From Pearson Correlation

By the way, there is a nice blog post about t-tests in Excel.